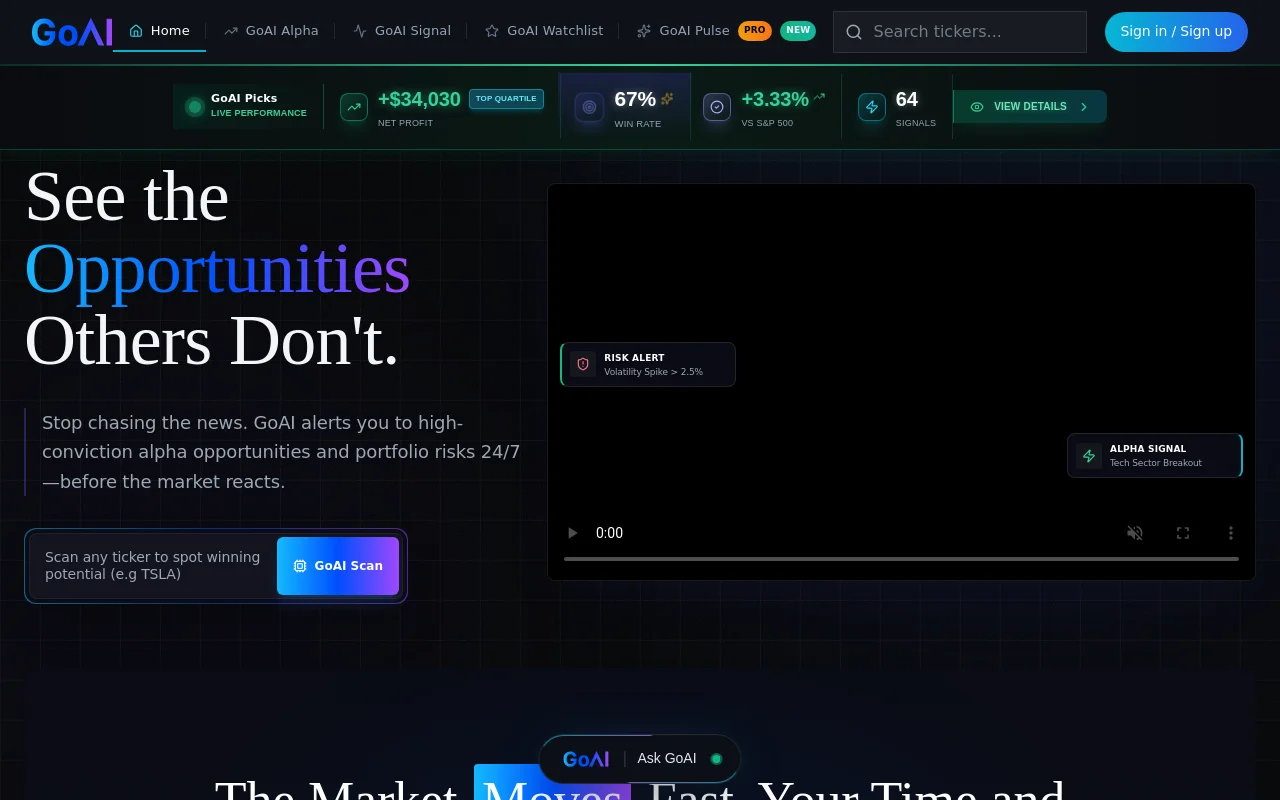

GoAI is an artificial intelligence-driven platform designed to provide investors with stock analysis, trading signals, and data-driven investment advice. Its core technology is based on an advanced AI framework and knowledge graph, capable of processing massive amounts of public data, news, social media information and proprietary analyst reports. Uncover non-obvious cross-industry connections and investment opportunities by mining and analyzing this data. The main advantages of this product include continuous working 24/7, providing high-certainty investment opportunities and portfolio risk warnings, visual display of market sentiment, etc. GoAI targets retail investors and provides them with institutional-level stock analysis services. Its pricing strategy is to provide a free trial, and users can experience the first week of professional-level insights for free.

Demand group:

["Retail investors: For retail investors who lack time and professional knowledge, GoAI can help them save a lot of time without spending a lot of energy sifting through market noise and studying financial reports. At the same time, the professional analysis and investment advice provided by the platform can make up for their lack of knowledge and avoid missing investment opportunities due to personal cognitive biases.", "Investment enthusiasts: Investment enthusiasts have a strong interest in the market, but may lack systematic analysis methods. GoAI's AI analysis and data-driven investment recommendations can provide them with new ideas and perspectives, helping them better understand the market and discover investment opportunities.", "Portfolio managers: Portfolio managers need to monitor market dynamics and the risk status of the portfolio in real time. GoAI's real-time market signal tracking and risk warning functions can help them adjust their portfolios in a timely manner, reduce risks, and improve the performance of their portfolios."]

Example of usage scenario:

Investors use GoAI to discover investment opportunities in Tesla, understand its profit forecast and key themes in advance, and make investment decisions.

Portfolio managers use GoAI's real-time market signal tracking and risk warning functions to adjust investment portfolios in a timely manner and reduce risks.

Investment enthusiasts use GoAI's AI analysis and data-driven investment advice to discover some non-traditional investment opportunities and increase return on investment.

Product features:

Stock analysis: The platform uses AI technology to conduct comprehensive and in-depth analysis of stocks, covering from basic financial data to complex market trends, clearly presenting the potential value and risk status of stocks to investors, and helping investors make more informed investment decisions.

Real-time market signal tracking: monitor market dynamics in real time and capture various key signals immediately. No matter how rapidly the market changes, investors can obtain the latest information in a timely manner and seize investment opportunities.

Data-driven investment recommendations: Based on a large amount of public and proprietary data, advanced data analysis methods are used to generate targeted investment recommendations. These recommendations have a solid data foundation and provide investors with reliable investment directions.

Discover high-certainty investment opportunities: Through in-depth analysis, we can explore non-obvious cross-industry connections and find those investment opportunities with high potential, helping investors discover investment opportunities that others cannot see and improve their return on investment.

Visualization of market sentiment: Display market sentiment with intuitive charts and indicators, such as the VIX index, etc., allowing investors to quickly understand the overall atmosphere and trends of the market, thereby better grasping market dynamics.

Event impact prediction: Before an important event occurs, analyze and predict its possible impact, such as predicting the profit and loss probability and key themes of financial reports, to help investors prepare in advance and reduce investment risks.

Usage tutorial:

Step 1: Visit GoAI’s official website https://goai.digital, or download the GoAI app on the App Store or Google Play.

Step 2: Register and log in to your account. You can choose to try the Pro-level insight information for the first week for free.

Step 3: Enter a stock code, such as TSLA, on the platform to scan the stock and obtain relevant analysis and signals.

Step 4: Check different information sources such as Global Macro, Sector Rotation, Earnings, etc. to understand market dynamics and investment opportunities.

Step 5: Track market signals and event impact predictions in real time through GoAI Signals feed and Event Analysis feed.

Step 6: Make investment decisions based on the analysis and recommendations provided by the platform, combined with your own investment goals and risk tolerance.