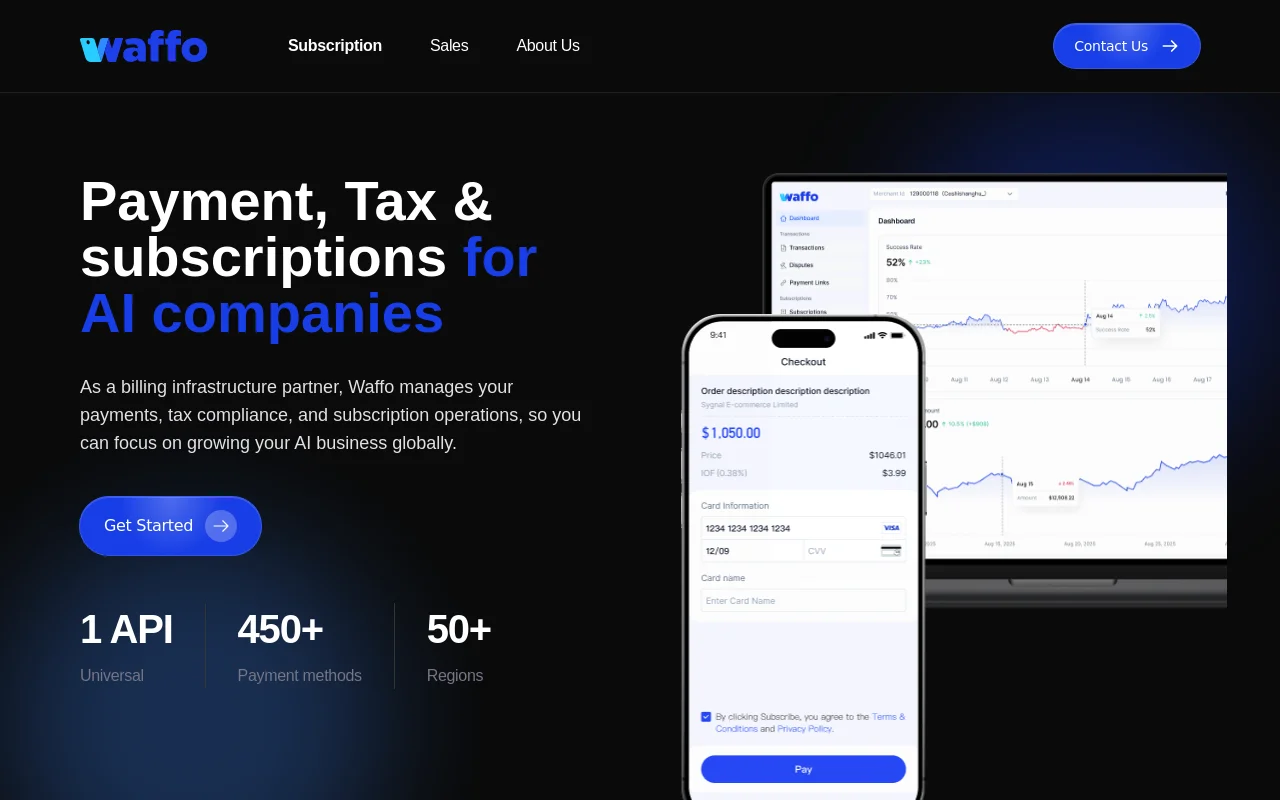

Waffo is a one-stop solution specially built for AI companies. Its core functions cover global payments, tax compliance, fraud protection and other aspects. The importance lies in helping AI companies solve complex financial and operational problems in global operations, allowing companies to focus on core business growth. The main advantages include providing a single API access, supporting 450 payment methods and 50 regions, having intelligent payment routing, subscription management and global compliance processing capabilities, automatically recovering failed transactions, and providing accurate revenue analysis reports. The product background is developed in response to the payment and tax problems faced by AI companies in global business expansion. Pricing information was not mentioned. The product positioning is to become a reliable infrastructure partner for AI companies’ global business operations.

Demand group:

["AI startups: For AI startups in the initial stage, Waffo provides easy-to-use integration solutions and comprehensive functional support to help them quickly build a global payment and operation system, reduce operating costs and risks, and focus on product research and development and market expansion.", "AI large enterprises: Large AI enterprises have extensive business and a large number of customers around the world. Waffo's multi-currency support, global tax compliance and intelligent payment routing and other functions can meet their complex business needs, improve operational efficiency and payment success rate.", "Developer team: Whether it is a professional development team or individual developers, the single API and complete testing environment provided by Waffo allow them to quickly integrate payment and operational functions, save development time and energy, and focus on the development of the core functions of the product."]

Example of usage scenario:

An AI image recognition startup company has successfully expanded its global market and improved its payment success rate and customer retention rate by using Waffo's payment and subscription management functions.

A large AI intelligent customer service company relies on Waffo's global tax compliance and fraud protection functions to ensure the stable operation of its business on a global scale and avoid tax risks and fraud losses.

An AI software developer used Waffo's revenue analysis function to gain an in-depth understanding of the financial status of the business, formulated a reasonable pricing strategy, and achieved rapid business growth.

Product features:

Smart billing function: Provide a complete billing solution for AI companies. Through smart payment routing, the optimal payment method is automatically selected according to different payment scenarios and user preferences, while efficient subscription management is performed to ensure global compliance, so that enterprises do not need to worry about complex billing processes.

Precise revenue analysis: Provide accurate and easy-to-obtain revenue reports for SaaS and AI companies, helping companies understand the financial status of the business in real time. Through detailed data analysis, it provides strong support for corporate decision-making and helps companies formulate reasonable development strategies.

Intelligent payment recovery: Use intelligent algorithms to automatically recover failed payment transactions, reduce customer loss due to payment failures, try to re-initiate payments through a variety of methods, improve payment success rates, and effectively increase customer retention rates.

Global tax compliance: Assist companies to easily expand their business around the world, be responsible for registration, calculation, collection and remittance of sales tax and value-added tax, handle the entire process of payments and fees, ensure that each transaction complies with local tax regulations, and allow companies to avoid tax risks.

Powerful fraud protection: Built-in advanced fraud prevention mechanism, real-time monitoring and risk assessment of each transaction, timely identification and prevention of fraud, ensuring the company's financial security and stable business operation.

Usage tutorial:

Step 1: Visit Waffo’s official website, click the “Get Started” button to register, and fill in the company-related information to complete the registration process.

Step 2: After successful registration, select the corresponding functional modules according to the needs of the enterprise, such as billing, income analysis, payment recovery, etc.

Step 3: Use a single API to access Waffo's system for development and testing. The entire process can be tested in the simulator and payment method sandbox.

Step 4: After completing the test, deploy the system to the production environment and start processing actual payment, tax and subscription services.

Step 5: During use, you can contact Waffo's technical support team at any time for help, and at the same time optimize business operations based on the analysis reports provided by the system.