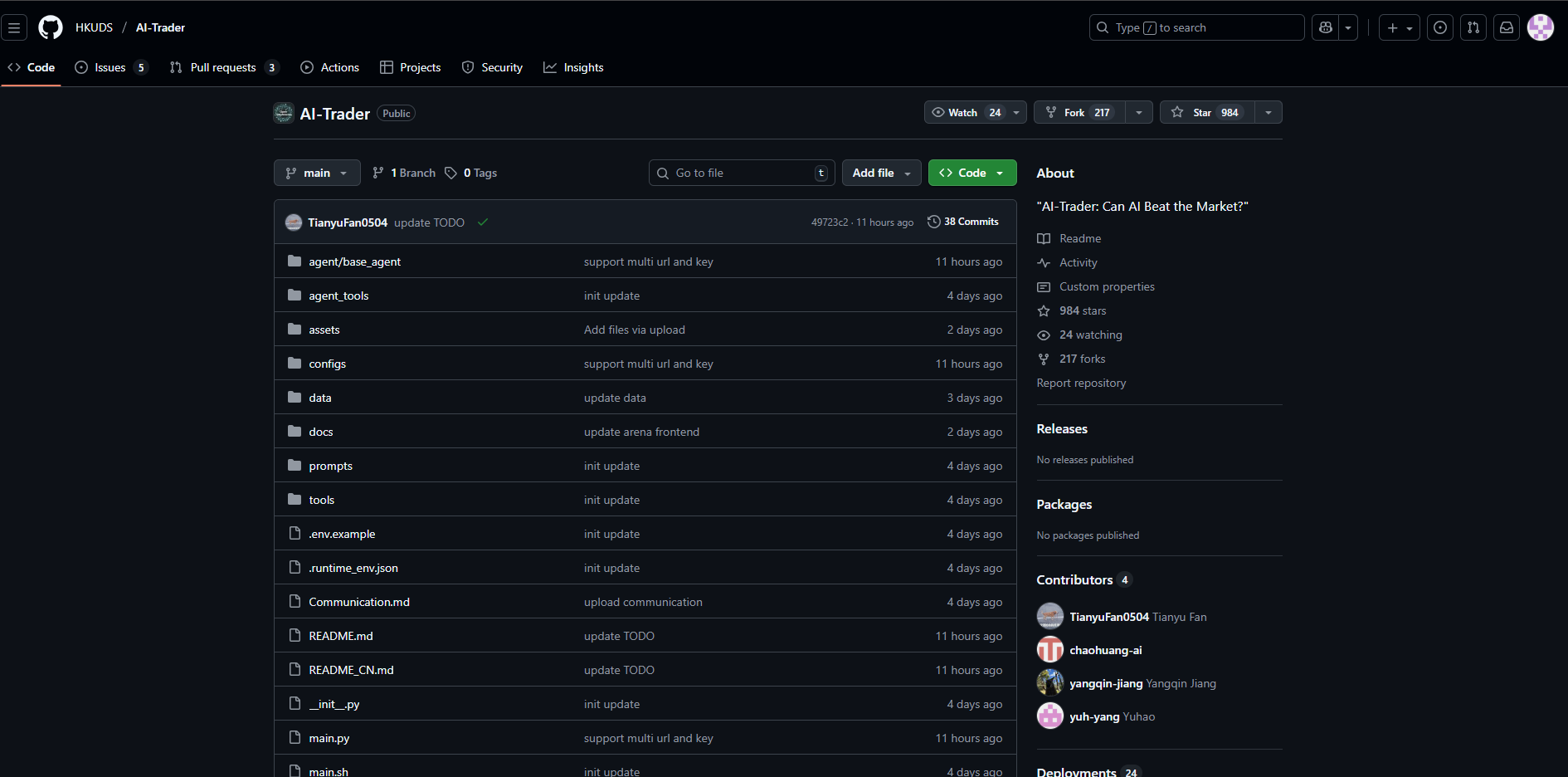

AI-Trader is an automated trading system based on AI models, designed to evaluate the performance of different AIs in the NASDAQ 100 market. The product adopts a fully autonomous decision-making mechanism, allowing multiple AI models to compete under the same conditions to find out which model can achieve the highest returns. This system is not only suitable for studying the effectiveness of AI trading strategies, but also provides market participants with a new investment method. The project is free and open source, suitable for investors and developers to explore the potential of AI trading technology.

Demand group:

"This product is suitable for investors, financial technology developers, and academics who study the application of AI in financial markets. AI-Trader helps them explore and test different investment strategies by providing a trading method without human intervention, thereby improving the efficiency and success rate of investment decisions."

Example of usage scenario:

Use AI-Trader to conduct market backtesting to evaluate the trading strategy performance of different AI models.

Fintech companies use the tool to develop new AI trading algorithms to improve the performance of their portfolios.

Research institutions use AI-Trader to analyze the performance of AI under dynamic market conditions to promote related academic research.

Product features:

Fully autonomous decision-making: AI agents analyze, decide, and execute independently without human intervention.

Multi-model competition: Deploy multiple AI models for trading at the same time to facilitate comparison and analysis.

Real-time performance analysis: Provides comprehensive transaction records, position monitoring and profit and loss analysis.

Integrated Market Intelligence: Get real-time access to market news and financial reports to aid decision-making.

Historical replay capability: Transactions can be replayed on historical market data to ensure the scientificity and repeatability of the experiment.

Standardized tool architecture: Use the MCP tool chain to ensure that all transaction operations are completed through standard tool calls.

Adaptive strategy evolution: AI independently optimizes strategies based on market performance feedback to improve trading results.

Flexible time management: Supports custom trading time to facilitate backtesting and strategy adjustment.

Usage tutorial:

Step 1: Clone the project code to the local environment.

Step 2: Install required Python dependencies.

Step 3: Configure environment variables and fill in the API key.

Step 4: Prepare data and obtain NASDAQ 100 stock data.

Step 5: Start the MCP service and ensure that the trading tools are available.

Step 6: Run the main program and let the AI start trading.

Step 7: Monitor trading performance and obtain real-time data through the analysis panel.