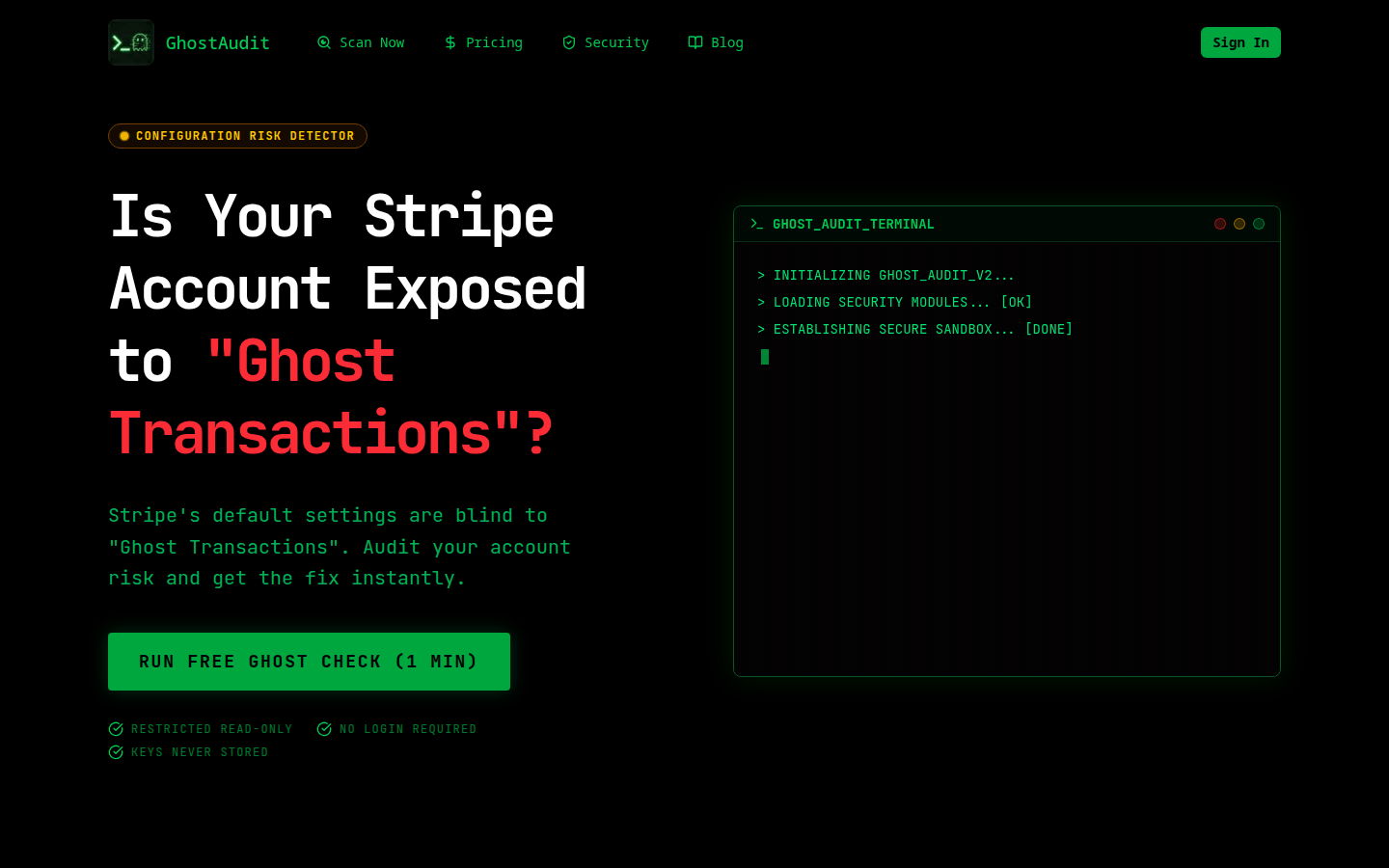

Ghost Audit is a tool for auditing Stripe accounts. Its main function is to identify and reduce revenue losses caused by ghost transactions. Ghost transactions are payment methods that appear legitimate but bypass Stripe Radar fraud detection, allowing fraudsters to test stolen credit cards without triggering an alert due to the lack of key verification data such as billing address AVS or CVC checks. The importance of this tool is to help merchants ensure Stripe account security, compliance, and maximize profits through real-time monitoring and AI-driven risk scoring. The product background is a targeted solution developed based on the vulnerability of ghost transaction detection in many Stripe accounts. In terms of price, there are three options: a one-time scan for $9.90, a monthly plan for $19.90, and an annual plan for $99.90. Its positioning is to provide security and risk prevention and control for merchants who use Stripe for payment.

Demand group:

["Stripe merchants: For merchants who use Stripe for payment processing, Ghost Audit can help them identify and eliminate risks caused by ghost transactions, reduce revenue losses, and improve account security and compliance.", "E-commerce entrepreneurs: E-commerce businesses usually face higher risks of payment fraud. This tool can help them effectively prevent fraud and ensure the stable development of their business without affecting the user experience.", "SaaS Enterprises: SaaS enterprises rely on Stripe for subscription payments, and ghost transactions may lead to customer churn and revenue loss. Ghost Audit can help them discover and resolve potential risks in a timely manner to ensure business sustainability."]

Example of usage scenario:

Alex R, the founder of the SaaS tool, discovered through Ghost Audit that billing address verification was turned off by default, resulting in a loss of $8,400. After using this tool, the risk was eliminated.

Sarah L, CTO of the e-commerce platform, Ghost Audit revealed unknown configuration vulnerabilities and fixed them within minutes, resolving high-risk issues.

An e-commerce merchant discovered a large number of ghost transactions after scanning using Ghost Audit. By customizing Radar rules, it effectively reduced disputes and losses.

Product features:

In-depth risk audit: Use the proprietary ghost pattern detection algorithm to scan the past 1,000 Stripe transactions to comprehensively quantify the true risk exposure of the account, including pattern recognition, risk scoring and leakage analysis, etc., to help merchants gain an in-depth understanding of the potential risks of the account.

AI Radar Rule Generator: Generate accurate Radar rule codes based on merchants’ transaction data, optimize business settings, effectively block transactions without AVS and avoid fraud risks without affecting conversion rates.

Real-time monitoring: 24/7 autonomous monitoring of the checkout process can detect card testing behavior in real time and provide timely warning before it escalates into large-scale disputes, effectively preventing attacks and reducing dispute costs.

Risk report generation: After scanning, a detailed risk report is generated to display the ghost transactions in the account, including transaction status, missing verification data, etc., allowing merchants to clearly understand the risk status of the account.

Customized rule configuration: Generate customized Radar rules based on the merchant's specific business needs and transaction data to ensure the effectiveness and pertinence of the rules and improve the accuracy of fraud detection.

Secure data processing: Only limited read-only keys are used for scanning, no keys are stored, and no funds, settings, and customer data are involved, ensuring data security and privacy.

Usage tutorial:

1. Start a free audit: No login required, click to start scanning.

2. Enter a read-only key: Use a restricted key (rk_live) for security scanning.

3. View the risk report: After the scan is completed, view the detailed risk report to understand the account risk status.

4. Apply customized rules: Apply customized Radar rules generated based on reports to Stripe accounts to improve fraud detection capabilities.